Do you have your own real estate agent business plan?

Let’s be honest, starting a career in real estate is like launching a new business. As an agent, you are your own brand. You have to find your own leads and nurture your own clients. And ultimately, you’re responsible for the production and financial success of your business.

The problem is that standard real estate courses don’t teach agents how to be business owners. Did your real estate courses help you craft your own real estate agent business plan? Mine certainly didn’t!

And that’s a real shame because business planning is key to being a successful real estate agent! This isn’t an industry you can muddle your way through. You need to create a roadmap to success. A path to show you the way forward when business gets tough.

And that’s what this post is all about: creating The Ultimate Real Estate Agent Business Plan to help your real estate business succeed!

Quick note: this article was originally published in 2019; this is the new, updated version.

Before You Jump Into Your Real Estate Agent Business Plan

Before we get started, you should decide how you’re going to document your real estate agent business plan.

- A physical notebook: Putting pen to paper can be a powerful motivator! If you’re a notebook-keeper, grab that notebook and start writing.

- A doc: Of course some of us prefer the paperless route. You can just open a blank Google Doc or Word Doc and start typing.

- A ready-to-use template: You can find inexpensive business plan templates on Etsy. If you’re looking for a template that perfectly mirrors the steps in this post, check out The Ultimate Real Estate Agent Business Plan by Key Real Estate Designs.

There’s no right or wrong way to document your real estate agent business plan. The important thing is to pick whatever method feels natural to you so that you can complete this critical business planning process.

The Ultimate Real Estate Agent Business Plan

Word of warning: this is going to be a longgggggggggggg post! We have a whole lot of ground to cover. For easy reference, here is an outline of what to include in a real estate agent business plan:

- Branding

- Know Your Client

- Get Clear on Your Offer

- Transform Your Offer into a Vision

- Finance

- Performance from the Past Year

- Projections for the Upcoming Year

- Income Goal

- Tracking

- Long-Term Planning

- Marketing

- Know Where Your Leads are Coming from

- Schedule Your Marketing Activities

- Add New Marketing Activities Each Year

- Track Your Results

- Operations

- Services

- Supplies and Vendors

- Your Team

- Lead Follow-up

- Building Referrals

Let’s get to it!

1. Branding

The branding chapter of your real estate agent business plan consists of three main sections:

- Knowing Your Client

- Getting Clear on Your Offer

- Transforming Your Offer into a Vision

1. Know Your Client

Step Number One is all about knowing your audience. Starting the branding process from your clients’ perspective will help keep your real estate agent branding focused on your clients’ needs. So let’s pinpoint your ideal client first, and then we’ll figure out how to attract them with branding.

Choose Your Niche

Don’t be that agent who tries to appeal to all buyers and sellers in your area. By trying to appeal to everyone, you’ll never stand out to anyone. You need to niche down so that you are a perfect fit for the clients you most want to attract.

Many agents are hesitant to choose a niche because they don’t want to leave potential clients on the table. But there’s a big problem with being open to all clients: you’re competing with all agents.

But, if you niche down, you’re only competing with a handful of other agents in your niche. Yes, the pool of potential clients is smaller, but the odds of securing those clients are far greater. Would you rather catch 1% of 1,000 fish or 25% of 250 fish? Go for the higher conversion rates by sticking to a niche and becoming the go-to agent for that group.

To be clear, choosing a niche doesn’t mean you don’t work with other clients; it just means you’re targeting your marketing efforts to resonate with a specific group. If a lead outside your niche falls into your lap, by all means, convert that lead into a client and closing!

There are lots of ways to niche down, and you can combine several of them to carve out your unique niche. As you consider niches, ask yourself what type of client you most enjoy working with. Here are a few ways to niche down:

- Buyer or Sellers: You should specialize in one or the other, but stay flexible when your sellers are also looking to buy and vice versa. By the way, buyer/seller is not a niche by itself; it’s just the starting point of focusing on your niche.

- Specific Neighborhoods: If you have a geographic farm, that’s your niche.

- Specific Price Points: Do you focus on luxury estates, starters/fixer-uppers, or somewhere in between?

- Life Events: You could help first-time buyers, downsizers, or people looking for their “forever home”.

- Occupations: If you have a military base nearby or a large employer in town, you could specialize in helping those members/workers get settled in a new home.

- Property Type: How about focusing on agricultural land, condos, or multifamily?

Not sure which direction to go? Learn more by exploring 5 profitable niches for real estate agents.

This goes without saying, but I’m going to say it anyway: protected classes are not niches. It’s never acceptable to niche by race, religion, age, etc.

Create Your Client Avatar

Once you determine your ideal niche (like first-time military vet buyers, for example), you want to learn everything you possibly can about that group. Remember, these aren’t just clients. They’re real people with very real dreams, fears, preferences, and motivations.

Creating an avatar (an imaginary persona of your typical client) forces you to focus on what your ideal clients need from you and how you can best serve them. This will also help you understand how to appeal to them through your real estate agent branding.

There are lots of factors to consider when creating your client avatar. Here are some of the most important:

- Goals (by the way, buying or selling are never the goals; consider why they want to buy or sell)

- Values

- Fears

- Challenges

- How much your clients know about real estate (transactions in general, and the local market in particular)

- General demographics (age, gender, familial status, profession, annual income, formal education, etc. – again, you’re not filtering clients by any protected class, but you do need to have an idea of your average client’s demographics because that will factor into some of your real estate agent branding decisions)

- Where your client hangs out, online and offline

Just to reiterate, saying that your client avatar is a 30-year-old, unmarried female buyer doesn’t mean you’d ever discriminate against families with children. This avatar is simply an amalgamation of your typical client for the purpose of appealing to your target market with your branding efforts.

2. Get Clear on Your Offer

With your client clear in your mind, you can start to clarify your image, tailoring it to meet the needs of your client avatar.

Your Origin Story

We all know real estate agents are just superheroes without capes. And every good superhero has a solid origin story. What’s yours?

How did you come to be a real estate agent? What hurdles have you overcome to get to this point in your life? Which accomplishments are you most proud of? And how does that fit your client avatar’s expectations?

If you’re a native local, great! Part of your origin story is that you were born and raised in the area, so you know everything and everyone.

If you’re a transplant, great! San Diegan by birth, Angelino by choice. Still a great start to your story.

Write down your origin story. It’ll make a great addition to your professional bio!

Your Mission

Why are you doing what you’re doing? What drives you to hustle every day? And, again, how does that fit your client avatar’s expectations? Your personal mission should be meaningful to your clients.

Your Differentiator

Now’s the hard part: verbalizing your uniqueness.

Which of your prospective clients’ needs can you meet better than your competitors? That’s your differentiator.

Here are a few differentiator ideas:

- Best list-to-price ratio in your niche

- Best online presence

- Biggest professional network of investors

- Most experience with VA loans

- Only local agent who speaks Spanish

And if you’re really struggling to find your differentiator, how about offering something no one else is offering? Consider offering services like:

- Professional staging for all sellers,

- New home photo shoots for all buyers, or

- Complimentary annual property tax reviews to make sure your clients are never over-taxed (and if they are, you can offer your property tax appeal services on a contingency fee basis!).

There are a million ways to differentiate yourself. Figure out what’s going to make the biggest difference to your prospective clients.

Your 5 Magic Words

To fully cement your professional image, choose five magic words that best describe you and your brand. These magic words will guide all your real estate agent branding. If you look at your business cards, website, or marketing materials, and they don’t SCREAM these five words, then you’ll know something needs to be changed.

Your differentiator may immediately bring a word or two to mind. So might your client avatar.

Then you’re looking for words that convey an idea or emotion you want to resonate with your target audience.

These are going to be your five magic words. So own them and live them!

3. Transform Your Offer into a Vision

Now that you have a better understanding of your offer, you can turn it into a vision.

In this step, your unique real estate agent branding will really start to take shape!

Choose Your Brand’s Name and Tagline

Naming your brand is harder than most agents expect, mostly because many of the best names are already taken. You need a name that you can “.com” for your website, but that name also has to be available across all social media platforms. Here are a few pointers to simplify the process:

- Keep it under 15 characters. Otherwise, you’ll have to abbreviate your X (formerly Twitter) handle, which dilutes your branding.

- Think lifestyle and location. MB Luxury, Venice Living, or Living in the OC for example. These all focus on the lifestyle of your target audience.

- Never incorporate your Broker’s name. Because 1) it’s probably trademarked and 2) you don’t want to tie your brand to your broker because that creates complications if or when you decide to part ways.

- Check to see if the domain name is available for your website. If you type your idea into Bluehost’s domain search, it will tell you if the name is available.

- Then check to see if the name is available on social media platforms. Is there already an @VeniceLiving on Insta?

If you’re struggling with this step, don’t let it prevent you from moving forward. When in doubt, use your name. If you have a unique name, it could be your brand name by itself. Otherwise, you could incorporate your name with your lifestyle or location. OC Estates by Sarah, Sean Sells Santee, or Lilly’s Life in LB.

Then you can craft your tagline. Skip the cheesy rhyming taglines of the last century. Instead, explain your differentiator in just a few words. That’s a much more powerful tagline.

Create a Mood Board

The best way to start visualizing your brand is to create a mood board. A mood board is basically just a collage of images with a cohesive look that reflects your idea of your brand. These could be patterns, lifestyle photos, design elements, and color swatches.

Here are a few examples:

Your mood board should be a visual reflection of your offer. If you offer fun and fresh service for first-time buyers, your mood board should scream fun and fresh with bright colors and trendy designs. And if you offer home-grown expertise in agricultural properties, your mood board should whisper farmhouse chic with natural colors and materials.

Want a shortcut?

If you don’t have time to scour the Internet looking for mood board images, just enter “Mood Board” or “Branding Board” on Pinterest. You’ll find tons of professionally curated boards to inspire your personal mood board.

But one quick word of caution: you could get stuck at this stage for weeks because there are so many engaging boards to see. My recommendation is to set a timer for 20 minutes. Browse away, pinning the images that really speak to you. Then use 10 additional minutes to narrow down your selections until you have a brand board you love.

Choose Your Official Brand Colors

One of the reasons I love the Mood and Branding Boards on Pinterest is that they usually come with a beautifully coordinated color palate.

Choosing colors is difficult for most of us because there are so many shades and it’s hard to know which colors best complement each other. Using the colors from a professionally designed board ensures that your colors all work together perfectly.

If you see a color you love, but can’t figure out exactly what color it is, here’s a quick and easy way to find out:

1. Save the image to your computer.

2. Upload that image to imagecolorpicker.com.

3. Click anywhere on the image to get the details for the color you want from the image.

You’ll be able to use the HTML code or the RGM code to get your colors just right on your website, marketing materials, and social media posts.

So you’ll always have perfectly matched brand colors!

Decide on Your Font(s) and Any Design Elements

It’s generally best to stick with two fonts: one bold, and one for easy readability. Your bold font will go on your headers, titles, and logo, and your readability font will be everything else.

Like with colors, you want your fonts to complement each other. There are lots of resources online to find font pairings. Here’s an example of some front combinations from Inkbotdesign.com:

Just make sure you have access to your chosen fonts on all the platforms you use (your website, your marketing design software, etc) as some platforms only offer limited font selections.

If you’re going to have any custom design elements (stripes, brush strokes, patterns, etc), now is also the time to select those.

Create Your Logo

Finally, it’s time to choose your logo.

This is another step that stalls lots of agents. But we have a shortcut to help you get this done quickly and easily.

Head to Etsy. They have lots of personalized logo packs at great rates.

Some Etsy sellers even offer custom-designed logos. If you don’t see an existing logo pack, you can just contact those sellers with your fonts, colors, brand name, and any of your unique design ideas, and they’ll get you set up in no time.

Easy!

Before long, your target audience will start to recognize your unique real estate agent branding. They’ll know what you and your brand stand for. And they’ll know how to reach you when they’re ready to buy or sell!

2. Finance

The finance chapter of your real estate agent business plan consists of the following sections:

- Performance from the Past Year

- Projections for the Upcoming Year

- Income Goal

- Tracking

- Long-Term Planning

1. Review Your Performance from the Past Year

To know where you’re going, it helps to know where you’re coming from.

Reviewing your financial performance from the past year will give you an idea of what to expect (in terms of income and expenses) for the coming year.

A quick note about expenses: As an independent contractor, you have more than just personal expenses to consider. You also need to consider business expenses. We’ll discuss both.

If this is your first year in real estate, your prior year’s data won’t include relevant business expenses or reliable income figures. You’ll just need to spend more time researching average income and expense data in Step 2. But you will still benefit from reviewing last year’s personal expenses so you’ll know how much to budget in those categories for the coming year.

Expenses

Most agents find it helpful to look at the expenses first when reviewing their financials. When your income is uncertain, starting with your expenses lets you know exactly how much income you need to make to cover all your needs. So we’re going to follow that method by listing expenses first.

Now, I like to start with personal expenses since many of these are essential to your life, regardless of the current state of your business.

Personal expenses include:

- Housing

- Utilities

- Personal Vehicle

- Food

- Personal Care

- Insurance

- Debt Payments

- Savings and Investments

- Charitable Giving

All you need to do is list all your personal expenses and assign an amount to each. You may find it helpful to list both the annual total amounts and the average monthly amounts.

Then you can move on to your business expenses.

Business expenses include:

- Work Vehicle

- Work Cell Phone

- Office Space (if not covered by your Broker)

- Marketing

- Website Hosting

- Signage

- Membership Dues

- Client Gifts

- Federal and State Income Taxes

If you’re new to real estate, you’ll need to account for a few start-up costs as well:

- Licensing fees

- A real estate website (a must for today’s serious agents)

- Any onboarding fees charged by your broker

- Business cards

- Initial self-promotional marketing

Do you feel like your expenses are too high in any category? Ask yourself if it’s reasonable to cut back on that expense in the coming year. If so, great! And if not, at least you’ll know to budget enough for that category in the coming year.

Income

The bulk of your income will, in all likelihood, come from real estate transactions. But this shouldn’t be your only source of income.

Savvy agents are diversifying their income streams to recession-proof their businesses and reach financial independence. Check out our massive list of 55 Ways to Make Money in Real Estate for some income ideas that will complement your real estate business.

Just like you did with your expenses, list your income sources from this past year and the amounts earned from each source.

Profit

Your income minus your business expenses equals your profit.

How did you do last year? Are you satisfied with last year’s profit? Or do you need to lower your business expenses, increase your income, or both to reach a profit you’re happy with in the coming year?

Cash Flow

Your income minus your total expenses (personal and business) is your cash flow. This shows how much more money you make than you spend.

As long as you’re including savings and investments in your expenses (which you absolutely should be, otherwise those will end up neglected!), your cash flow number doesn’t need to be large. You just want to be sure you’re making more than you’re spending.

If there’s anything you don’t love about your financials from the past year, don’t panic. Instead, focus on what you want to do differently in the next 12 months. That’s what we’ll do in Step 2.

2. Plan Your Financials for the Coming Year

Now it’s time to create your real estate agent financial plan for this coming year.

- How much do you plan to spend?

- And how much do you plan to earn?

Expenses

Using last year’s expenses as a guide, write down your estimated expenses in each category for the coming year. You may have to do a little research to get estimates on some figures if this will be your first year incurring that particular expense.

The most important thing when estimating your expenses is to be as accurate as possible. Many of us have a tendency to think our numbers should be lower, so we underestimate our expenses, and subsequently end up breaking our budget.

A good rule of thumb is to budget high. If you come in under budget, great! You’ll have more money at the end of the year to invest in business expansion.

Income

With your expenses calculated, you now know exactly how much money you need to make this year to cover all your expenses.

How does that number line up with last year’s income?

Do you expect this year’s income to be similar?

Again, accuracy is key. Your income goal should be achievable, but it should also be difficult enough to really make you work.

By the way, in the next step, we’ll create a plan to make your income goal a reality. That step will be a good litmus test to see if your income goal is reasonable.

Profit

Assuming you hit your planned expense and income figures this year, what will your profit be? Again, it’s just income minus business expenses.

How does this projected profit compare to last year’s profit? Are you happy with this profit? If not, now’s the time to review your projected expenses and income to see if you need to make any adjustments.

Cash Flow

When you subtract your total expenses from your projected income, are you still at a positive number? Because you need to be!

3. Create a Plan to Meet Your Income Goal

Now that you have an income goal in mind, we need to create a bulletproof plan to hit that goal.

To do this, we need to answer two questions:

- How many homes do you need to sell this year to meet your income goal?

- How many leads do you need to reach to sell that many homes?

Let’s look at each question in turn.

How Many Homes Do You Need to Sell?

Here’s the formula to calculate the number of homes you need to sell:

Income Goal

————————————————————————————————

(Average Home Price x Your Average Commission Percentage x Your Commission Split)

For anyone not algebraically inclined: we’re just figuring out your after-broker commission from an average sale, and then dividing your income goal by that number.

As an example:

If the average home price in your niche is $250,000, the average commission per agent is 3%, and your split with your broker is 50%, you would need to sell 27 average homes to generate $100,000 in gross income. ($250,000 times 3% = $7,500 x 50% = $3,750. So you make $3,750 on each average transaction. And $100,000 divided by $3,750 is 26.666 houses, rounded to 27.)

So, what’s your magic number?

Now, how are you going to meet that sales goal?

How Many Leads Do You Need to Reach?

First, let’s break down your home sale goal by month so it’s less daunting. Divide your magic number by 12 to figure out how many homes you need to sell each month on average.

Now, how many leads do you need to reach each month to sell that many homes?

To figure this out, you need to know your conversion rate. How many leads does it take on average to close a single deal? For seasoned agents, this is a matter of tracking your leads and your closed deals to know your personal conversion rate. For new agents, 100 leads for every 1 closed deal is a safe estimate in most markets. This number will improve as you gain sales experience and establish yourself in the market.

Here’s the formula for calculating your monthly lead requirements:

number of deals needed x number of leads required to make one sale

That number may seem high. But let’s make it more manageable by figuring out how many leads you need to generate each day. To do that, divide your required leads per month by 16. Why 16? Because life happens, and you can’t reasonably expect to prospect every single day of every month. So we’re figuring 4 workdays for 4 weeks per month.

As long as you commit to hitting your prospecting target 4 days per week, there’s no reason you shouldn’t hit your income goal!

4. Tracking Your Finances

This is one of the most often ignored steps in creating a real estate agent financial plan: tracking.

How will you know if you’re on track to stay on budget and meet your income goal if you don’t track your finances through the year?

Unexpected expenses and sales droughts can completely derail your financial plan. It’s important to catch these in real-time so you can adjust your plan as needed to get back on track as quickly as possible.

Keep a monthly log for expenses, and one for income. And actually use them! That’s the tricky part. It’s a good idea to schedule 15-30 minutes each week specifically to log your income and expenses from the previous week. Put this recurring appointment in your calendar to remind you to build this financial habit.

5. Long-Term Planning and Tracking

The final step to creating your bullet-proof real estate agent financial plan is to create a long-term financial plan.

Long-term financial planning is difficult for real estate agents. It’s hard enough to plan for a single year. How are you supposed to plan 5-10 years (or more!) into the future?

No one expects you to accurately forecast your income and expenses for the next 10 years. But there are some long-term financial plans that wise agents track. Btw, if you want to learn more on this topic, check out Financial Planning for Real Estate Agents for a comprehensive overview.

Retirement

Planning to retire as a real estate agent is tough. You don’t have a 401(k) or a pension plan. So you have to plan for retirement on your own.

A Solo 401(k) is a great option because it allows you to contribute more each year than IRAs.

The key to retirement savings is to start early and save consistently. Compound interest will work its magic from there.

Aim to set aside a full 10% of your gross income for retirement. But start slowly if 10% sounds like too much for you to spare. Start with 3% of every transaction for the first year. Then 5% the next year. And keep increasing until you hit 10%. If you’re starting retirement savings later in life, you may need to save more. If you have other income-generating assets, like rental properties, you may be able to save less. Talk to a Certified Financial Planner (CFP) if you need help figuring out your retirement plan.

Your Dreams

It’s sad that most of us put such a low priority on our dreams.

How many of us desperately want to travel or open our own brokerages or start a non-profit for the community? And how many of us never do these things because we just don’t have the money?

Make your dreams a priority by building them into your financial plan every year. And tracking your Dream Fund finances over the long term.

Your Legacy

What do you want to leave for the next generation?

You certainly don’t need to leave an inheritance for your children, but you may want to help your children and/or grandchildren with education expenses as your legacy. Maybe you want to create a family business to leave behind? Or build a community park for future generations to enjoy. Or establish a non-profit to assist those who come after you.

If you want to leave a legacy like these, you’ll need to include them in your long-term financial planning.

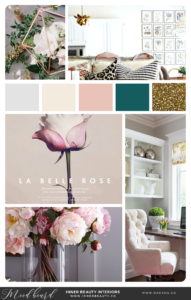

Your Net Worth

Tracking net worth year-over-year is one of the most rewarding financial exercises you can do!

Net worth is the best indicator of overall financial health. It’s a comparison of your debts to your assets. Think of it like this: if you sold everything you owned and paid off all your debts today, how much would you have left?

To calculate your net worth, start by listing all your assets and their present-day values:

- Checking Accounts

- Savings Accounts

- Retirement Accounts

- Investment Accounts

- Real Estate Holdings

- Vehicles

- Collectibles

Now, list all the current balances on all your debts:

- Mortgages

- Student Loans

- Auto Loans

- Credit Cards

- Business Loans

- Personal Loans

And finally, subtract the debts from the assets. The result is your current net worth.

The more assets you accumulate, the more your net worth will skyrocket. Especially if you acquire assets that appreciate, like real estate and financial investments (stocks and bonds).

Invest the time in calculating your net worth just once or twice per year. The motivation to improve your finances lasts long after you complete this small task. And as your net worth grows, you’ll find that you’re actually excited to calculate your new net worth and see how much your financial health has improved since the last check.

3. Marketing

Marketing builds on some of the foundation work you did in the branding and finance sections of your real estate agent business plan. With your financial goals and target market in mind, you can build a marketing plan to suit your audience and earn you enough leads to hit your goal.

The marketing chapter of your real estate agent business plan consists of:

- Knowing Where Your Leads are Coming from

- Scheduling Your Marketing Activities

- Adding New Marketing Activities Each Year

- Tracking Your Results

1. Know Where Your Leads Are Coming From

Do you know where your leads are coming from?

Online? Geo-farming? Cold-calling the Expireds? Somewhere else?

To know where your marketing dollars are making the most bang, you need to know which marketing methods are working for you.

If you don’t have a CRM (Customer Relationship Management) system that automatically tracks the return on investment for your leads, you can create a basic spreadsheet to handle this task. Just list your marketing methods in a column on the far left, then add columns for the:

- annual cost of each marketing method

- number of leads generated every year by each method

- cost per lead (annual cost divided by the number of leads generated)

- number of closed deals

- net profit from those closed deals

- ROI of each method (net profit divided by the annual cost)

(By the way, The Ultimate Real Estate Agent Business Plan on Etsy includes a ready-made template for you.)

If you’re brand new to the business and don’t yet have any data to analyze, don’t worry. Start your marketing strategy with three to five cost-effective marketing methods. My recommendations for most new agents in most markets are:

- Social Media Marketing. You can create professional profiles and post for free (check out How to Create a Lead-Generating Social Media Calendar for tips). And if you don’t have the time or design skill to create your own social media posts, sign up for DRIP by Key Real Estate Resources. You’ll get fresh social media posts and a new social media calendar delivered to you each month!

- Content Marketing. Add blog posts to your website to boost your search engine rankings so buyers and sellers can find you online.

- Calling FSBOs and Expireds. These people are actively trying to sell! Get out there and talk to them. In fact, consider hosting a FSBO seminar where you give real information about the home selling process. When sellers see what’s required to get top-dollar, they’ll probably list. And they’ll choose the agent who gave them the real info they were looking for! No time for a seminar? Offer a free FSBO guide instead.

- Mailers. Mailers may be old school, but they’re still a low-cost way to generate leads in many markets.

- Open Houses. While open houses aren’t effective for selling in all markets, they’re often effective at generating new leads.

2. Schedule Your Marketing Activities

Armed with your chosen marketing methods, it’s time to decide exactly when you’re going to take action.

You know that if it isn’t on your calendar, it won’t get done. Other tasks, like showings and inspections, will inevitably take priority because they are more urgent. Don’t let the urgent tasks keep you from the important tasks. And since your business doesn’t exist without a client pipeline, marketing is possibly the single most important task you can complete to keep your business growing. So schedule it!

Grab your calendar now and decide when you’ll:

- Launch your website (if you don’t already have one)

- Write and publish your blog posts (one per week is ideal)

- Post to social media (several times per week on your focus platforms, and at least once per week on the other major platforms). By the way, if you don’t have time to create your social media content, consider a service that creates the posts for you. DRIP by Key Real Estate Resources offers plans starting at just $9/mo.

- Call Expireds and FSBOs (daily! – so what time will you carve out every day for distraction-free phone marketing?)

- Send mailers (at least quarterly)

- Attend networking events

- Order any print media ads

- Launch any social media ad campaigns

- Etc, etc, etc

3. Add a New Marketing Activity Every Year

The real estate industry is always changing. What works one year might not work so well the next. And next year, you may find new marketing opportunities you weren’t even aware of this year.

Innovative agents experiment with new marketing technologies to keep their businesses growing.

In a hot market, you want to target FSBOs. When homes sell quickly, people think they can save on commission by selling themselves. So you need to show them what it takes to sell for top dollar.

And in a down market, you have a few options. One effective marketing activity to add in a down-market is to target renters. Home prices are lower than average, interest rates are favorable, and rents are increasing. Show these renters how to get a low down payment FHA or VA loan so they can use the market to their advantage! To really boost your leads, try creating your own Renter-to-Homeowner Program.

Another great example (albeit a more ambitious one!) of a new marketing plan for a down-market is to expand your services to include the property tax appeals service we mentioned in our discussion about your Differentiator. Most agents don’t even know this service exists, but it can provide you with a whole new income stream while simultaneously generating new leads and nurturing your relationship with past clients. And it’s far easier than you might imagine!

All you have to do is explain to the county that your client’s home is worth less than the value on their tax bill (which is very often the case in a down market). You do this by running comps, like you already know how to do. If the county agrees, they’ll lower your client’s property taxes, and you get a cut of that reduction. You’ll be able to pitch this service to all homeowners in your niche and gain some serious exposure for your real estate business! Learn more by reading How to Make Money With Property Tax Appeals.

There are tons of creative marketing strategies that most agents never consider. Trying a new marketing activity each year will keep your business growing in any market!

4. Track Your Results

To know what works you need to track your results.

Back in Step 3, we looked at where your leads are currently coming from, as well as the return on investment for each marketing method. Without tracking your leads, you’ll never have this valuable data to help guide your next marketing move.

Every time a new lead comes in, record the marketing source that drove them. If you have a fancy CRM database, you can record the information there. If you’re just keeping your leads in a simple spreadsheet, no problem! Just make sure you have a column to record the source. And if you don’t currently have a system, consider spending a few bucks on a done-for-you CRM template.

4. Operations

Last section! The operations chapter of your real estate agent business plan consists of five parts:

- Services

- Supplies and Vendors

- Your Team

- Lead Follow-up

- Building Referrals

Let’s take a closer look at each…

1. Services

Here’s a question most agents never think to ask themselves: What services should I offer?

Most agents think the answer is obvious. You sell real estate, right? What’s to ask?

This is a HUGE missed opportunity.

There’s so much more to real estate than sales. What other services could you offer to 1) diversify your income, 2) recession-proof your real estate business, and 3) best serve your clients?

Not sure what I mean? Here are a few examples of services that would complement your existing real estate practice:

Property Tax Appeals

We’ve mentioned property tax appeals a few times already. It’s just such a perfect fit for real estate agents (who already have about 95% of the knowledge and skills required to make money in property tax appeals), but surprisingly few agents are capitalizing on this homeowner need! Again, to learn more, check out How to Make Money With Property Tax Appeals

New Home Photo Shoots

If it isn’t on Instagram, it didn’t happen. Millennials and beyond want to show off their new home on social media. And they’re willing to pay for quality photos of themselves in their new place.

If you have photography skills (or you partner with a professional photographer for your listing photos), you can easily add this service to your real estate business.

Offer photoshoot packages to your buyer clients. But don’t stop there. Ask your colleagues if you can reach out to their buyers as well. Then promote your photoshoot services online. Before you know it, you’ll have a healthy new income stream!

And the best part: your clients’ social media pics become free advertising for you. Not only will this boost your photography services, but it can also bring you new buyers and sellers!

Read more about the benefits of offering new home photoshoots.

Property Management

If you want to land more investor clients (and wow them with your services!), offer property management services.

You know, tenant screenings, rent collection, maintenance requests, renewals, etc.

In most markets, property managers can command a 10-20% commission on the monthly rent for property management. It doesn’t take many units to add up to a substantial income stream.

Not interested in taking on ongoing property management work? Simply helping property owners screen new tenants can earn you a commission of around 50% of the first month’s rent, and then the day-to-day management can be handled by the property owner until they need new tenants. It’s an easy way to land a quick paycheck!

Other Services

There are tons of other ideas for additional income streams you can add to your real estate business. Check out 55 Ways to Make Money in Real Estate for more ideas!

2. Supplies and Vendors

Once you know what services you will offer, you can plan for your supply and vendor needs.

Supplies

As a service business, your supplies should be minimal. Here are a few supplies to consider:

- Laptop

- Phone

- Vehicle

- Printer

- Ink

- Paper

- Marketing Materials

- Software Subscriptions

Not much to it!

Vendors

Depending on the services you offer, you may need to utilize the services of several vendors.

On the real estate sales side, you have the standard players:

- Lenders

- Title Reps

- Escrow Officers

- Transaction Coordinators

- Marketing Publications

Then consider your other income streams. If you’re offering property tax appeals, you may want to hire a virtual assistant during appeal season to research assessed values and handle your data entry. If you’re offering new home photoshoots, you may want to partner with a professional photographer.

Ask yourself two key questions:

- Would a vendor boost the quality of my business?

- Is it worth paying someone to complete certain tasks so I can focus my energy where it will have the greatest impact?

If the answer to either question is yes, you should absolutely use a vendor.

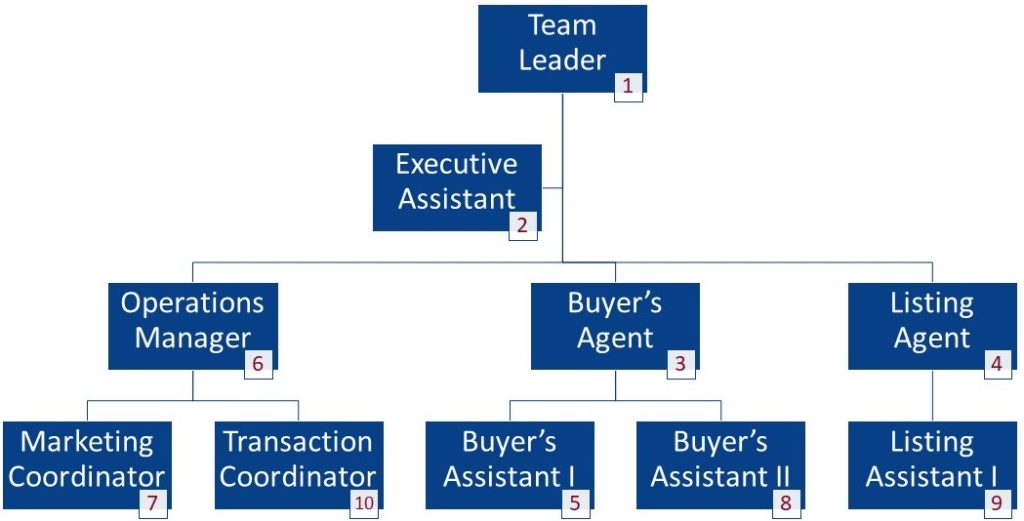

3. Your Team

For many real estate agents, you’re a team of one! You do everything yourself. But many agents want to grow a larger team: admin, buyer’s agents, listing specialists, etc.

Technology has opened many opportunities to help you grow your team. For example, your first team addition might be an inexpensive virtual assistant. You can hire a real estate assistant to take care of all your data entry, social media engagement, appointment setting, and even blog writing! And you don’t have to pay a full-time salary or offer benefits to a freelancer.

Tech has also introduced new challenges. Managing a virtual admin is very different from having an assistant in your office. You don’t get the face-to-face communication, and you don’t have the level of control that you would have over a full-time, in-office employee.

What works best for you? You can always try hiring a freelance VA for a short time to see if you’re comfortable with that arrangement. And if not, you can post a job ad on Craig’s List for a part-time (or full-time!) in-office assistant. This position is generally paid hourly. Depending on your market, this could be a $12-$20 per hour position.

Then you can branch out into specialists. The order of your hires will depend on your personal strengths and preferences. If you love listing and you’re great at it, you don’t need a listing specialist; focus on getting a buyer’s agent, marketing coordinator, and operations manager instead.

Be honest with yourself about which tasks you just don’t enjoy, and which tasks you struggle with, then hire people with those as strengths!

Just remember to give yourself time to grow. You don’t need to go from 1 person to 10 people this year. It takes time to build an effective team. Give yourself 6-12 months between each hire to avoid the worst of the growing pains.

Here’s an example of an org chart for a full real estate team (the numbers indicate a recommended order of hire):

4. Lead Follow-Up

First, schedule time every day for your lead follow-up. Every workday, you’re going to sit down at a designated time, open your CRM (Customer Relationship Manager), and follow up with your leads. Statistically, the best times to reach people are 8-10 am and 4-6 pm. So for the best chances of success, your follow-up should take place during those hours.

Studies have repeatedly proven that you don’t convert a lead to an active client in a single follow-up. It typically takes 7-8 touches for a lead to become your client. But that’s just an average. If you really want to boost your production, you need to follow up with every lead until they become your exclusive client.

What if your lead ends up listing with another agent? They’re still a lead. Contact them every few weeks to make sure they’re satisfied with their agent’s performance. If that listing expires, who do you think is going to land the new listing?

Here are some tips to increase your conversion rates from leads to clients:

- Put every single lead in your CRM. Every seasoned agent has been surprised by a lead they thought was low-quality. If you don’t log the lead, you lose them.

- When a new lead comes in, aim to reply to them within five minutes. The sooner, the better! Auto-responders can buy you a little time.

- Schedule your next follow-up immediately after every follow-up.

5. Building a Referral Business

What is your plan for after the deal closes? Is your current plan resulting in repeat business and referrals? If not, it’s time to re-think your post-close plan.

Lucky for you, I have a tried-and-true plan, ready for you to implement today!

Here’s a simple 3-step process for building a referral business:

Step 1: Showing Genuine Gratitude

Some agents are bucking the trend of closing gifts. They have already provided quality service, so they don’t see the need to spend part of their hard-earned commission on a closing gift.

But failing to give a closing gift is a huge missed opportunity.

First, many clients expect a closing gift because of the tradition of closing gifts. And your goal is always to exceed expectations, never to disappoint your clients.

Then there’s also the fact that closing gifts give you the opportunity to express your appreciation for your clients’ business. Without their business, you don’t survive as a real estate agent. So cultivate that attitude of gratitude and show your thanks with a thoughtful closing gift.

Lastly, closing gifts are an opportunity to make a lasting impression. A thoughtful closing gift helps your clients remember you. And a carefully selected closing gift can even generate referrals! Check out our list of 20 affordable closing gifts guaranteed to impress your clients.

Step 2: Providing Ongoing Value

Most agents consider the job done when the deal closes. Savvy agents know that a little ongoing effort pays off HUGE in referral and repeat business.

How can you help your clients after the sale? First-time homeowners are pretty clueless when it comes to home maintenance. Maybe you can send them a friendly list of home maintenance issues to tackle each season.

Offering property tax appeal services is a great way to provide value to your clients every year! Surprise and delight your clients by conducting a “complimentary property tax assessment review” every year. All you have to do is compare the assessed taxable value to the market value.

- If the assessed taxable value is lower than the market value, you can send the client a letter to let them know that you’ve confirmed that their property taxes for the current year are fair and ready to be paid in full.

- If the assessed taxable value is higher than the market value, you can let your clients know that your calculations indicate they are being over-taxed, and you’re happy to file a property tax appeal on their behalf to try to lower the taxes for them. (you can download a done-for-you letter template from our post on property tax appeals).

You should also send custom value estimates to your clients every 6-12 months to let them know how much their home has increased in value (just in case they’re thinking of selling).

Step 3: Maintaining the Personal Relationship

Don’t just rely on blanket marketing to stay in touch with your former clients. Schedule some personal touches as well to make sure your personal relationship is maintained.

Here are a few examples of effective personal touches:

- Send a Happy Housiversary Card every year. And maybe a small gift for that first year (if you really want to wow your clients!)

- Host an annual appreciation event, and invite all your formal clients. A simple party at home is nice and personal. But it’s certainly not the only option. Hosting an outdoor movie night is perfect for families. Offering a “Hidden Gems” tour of your city is great for areas with lots of non-natives. And renting out a boat for a sunset cruise with drinks and live music would be ideal for luxury market clients.

- Check in out-of-the-blue. Send a quick text just to say, hey I was just thinking about you and wondering how you’re doing. Is anything new and exciting going on? These messages are great because there’s no agenda. You’re just reaching out to an old friend to see how they’re doing.

With these personal touches, you’re not just staying in front of clients, you’re building on your personal relationships with them!

Congrats on Completing Your Real Estate Agent Business Plan!

Whew…I know that was a long read (or a long scroll, anyway).

But if you follow the steps outlined in this post, you’re going to end up with a complete real estate agent business plan to provide direction and accountability to your real estate business.

You owe it to yourself to complete your real estate agent business plan and set yourself up for a career full of success.

All the best to you and your business!