If you don’t know how to do a CMA, don’t worry; no one knows how to do a comparative market analysis before getting into real estate. CMAs are very much a learn-on-the-job skill.

But of course you have to start somewhere. And for some insane reason, most pre-license real estate courses don’t cover the CMA process. So consider this your official Intro to CMAs course.

In this post, we’ll cover several topics:

- What is a CMA in real estate?

- How do CMAs work?

- Top CMA providers (and whether they’re worth the expense)

- How to do a CMA in 5 steps

Let’s dive in!

What is a CMA in Real Estate?

A CMA in real estate stands for comparative market analysis (although some markets prefer competitive market analysis). A CMA is a tool used to assign a value to residential real estate by comparing the subject property to recent sales of comparable properties. You’ve probably heard the expression “running comps,” right? Running comps is a more fun way to say you’re working on a CMA.

How Do CMAs Work?

When doing a CMA for a home, you’ll find recently-sold properties that are comparable to your subject property. Of course these “comps” aren’t an exact match for your subject property, so you’ll need to make adjustments to the sales prices of the comps to see what the sales prices of those comps would have been if they had been identical to your subject property. Once you make these adjustments, it’s like you’re comparing apples to apples, and you can find the market value for your subject property.

There are several reasons real estate agents do CMAs. You can use a CMA to:

- Help sellers determine a listing price.

- Help buyers determine an offer price.

- Earn new clients by offering a complimentary home valuation to homeowners who might be interested in selling if they can get a certain price.

- Establish fair market value rental rates for investor clients.

- Get homeowners’ property taxes lowered (which is a lucrative income stream on its own, and a unique competitive advantage in almost any market – if you’re new to real estate, consider offering property tax appeal services to help stabilize your income and get in front of potential clients).

Once you know how to do a comparative market analysis, you’ll be able to value homes for any of these reasons. It’s a critical skill for all real estate professionals.

CMA Providers

Lots of agents subscribe to a CMA service (like Cloud CMA or Toolkit CMA) to help with calculations and formatting. But these services aren’t 100% necessary. Especially if you’re on a tight budget. Once you know how to do a CMA, you can make your own template in MS Excel or Google Sheets. It costs nothing but your time, and you can re-use it for all your future CMAs.

And if you’re not super comfortable creating spreadsheets, you can always buy an inexpensive template online. It probably won’t even cost as much as a single month from a CMA service, and you’ll be able to re-use it for all your CMAs.

But to use your CMA template, you need to know how to do a CMA, so let’s get into the details. Here are 5 simple steps to completing a CMA.

How to Do a CMA in 5 Steps

Step 1: Know Your Subject Property

Before you can start selecting comps, you need to know all about your subject property, so you’ll know what you’re trying to compare other homes with.

In general, you want to know anything that would affect the value of a home or help you identify it. Things like:

- Property address

- Neighborhood

- Characteristics of that neighborhood

- School district

- Assessor’s parcel number

- Lot size

- View

- Improvement size (living square footage)

- Number of bedrooms and bathrooms

- Year built

- Amenities (like a pool or spa if available)

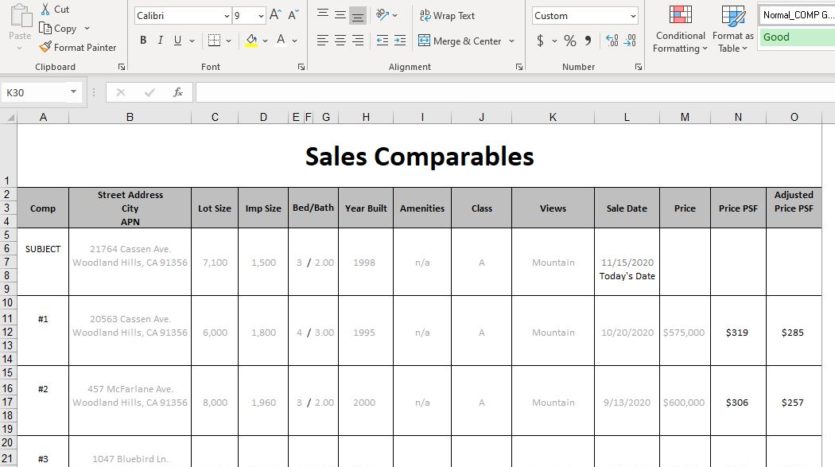

Here’s an example of a subject property:

| Neighborhood | South of Ventura Blvd, West of Topanga Canyon Blvd., Woodland Hills area of Los Angeles, 91364 zip | |

| Neighborhood Characteristics | easy access to the 101 Freeway, close to shops and dining on Ventura Blvd; some homes have valley and mountain views | |

| School District | Los Angeles Unified School District: Calabash Street Elementary, Hale Middle School, El Camino Real Senior High School | |

| Assessor’s Parcel Number (APN) | 2075-023-051 | |

| Lot Size | 6,305 total sq. ft., 6,098 usable sq. ft. (there is a steep, 5-story hill in the back yard that makes some of the square footage unusable) | |

| View | Neighborhood | |

| Improvement Size | 1,459 sq. ft. | |

| Number of Beds / Baths | 3 / 1.75 | |

| Year Built | 1962 (renovated 2012 – new roof, new electrical, new baths, new flooring, updated kitchen, new appliances) |

Important: Never include the assessed value (or any other value estimate) in this list of details. You don’t want to skew the market data by working around a value; you want to let the market data speak for itself. And never check the Zestimate®!

Step 2: Choose Your Comps

As mentioned previously, comparable properties (“comps”) are used to indicate a fair market value for your subject property. The logic behind this method is that if an ordinary buyer paid $X per square foot for a house, exactly like your subject property, from an ordinary seller on 1/1/2020, then your subject property must have also been worth $X per square foot on that date.

A word about comps: Comps are heavily subjective! You may think the house across the street is a better comp because it was built at the same time on the same size lot, while another agent may think the house next door is a better comp because it is the same square footage with the same view. It’s totally ok to disagree with other agents. You just want to be able to show that you used logic to select properties that are similar to your subject. This is why it’s so critical for agents to know their markets inside and out.

But I can certainly give you some general advice for choosing the best possible comps.

| Keep the big picture in mind when looking for comps: you’re trying to find 3-5 homes that are similar to your subject and sold recently. Location is the most important factor (pay attention to school districts and views when considering location), followed by timeframe (how recently did the sale close), then construction (size, # of beds/baths, year built, etc.), then amenities (pool, spa). |

As an agent, you have access to your local MLS, which allows you to find comps. If you don’t have MLS access for any reason, you can always use Redfin (my preferred tool) or Zillow. Start your search by narrowing the criteria by location. Zip code is a great starting point, but if your subject property is on the edge of a zip code, and the next zip over is really similar to yours (just as desirable, same amenities, same school quality, etc.) extend your search to that code so you capture those comps as well.

If you’re in a dense city, you may want to narrow down further – possibly as narrow as your condo complex if you’re in a large condo building. If you’re in a small town, you may even want to check the whole town because values won’t vary too much throughout town. You know your neighborhood better than I do; you know what your neighborhood’s all about and if the adjacent neighborhoods are similar to yours.

Now, filter by property type and include only sales records (remove all listings): if your subject is a house, only search houses. A condo? Only search condos. You may need to check sales records for the year or so. You can always eliminate some of the older sales as needed. Oh, and make sure to exclude short sales; short sales are not arm’s-length transactions because the seller is considered distressed and under pressure to sell, so short sales cannot be considered as comparable sales.

When you have these basic criteria filtered, you can export the results to an Excel sheet. In Redfin, for example, you just scroll down the property list on the right side and click “(Download All)”, then open the document in Excel and save it to your computer. You may want to change it from a .cvs file to an Excel (.xlsx) file by changing the “save as type” when saving.

Don’t panic at the mess of data that pops up in the spreadsheet. You can get rid of everything on the spreadsheet you don’t need so the data is more manageable. You can delete all columns EXCEPT:

- Address

- City (if all the results are in the same city, you can delete this too)

- Zip (if all the results are in the same zip, you can delete this too)

- Beds

- Baths

- Location

- Ft.

- Lot Size

- Year Built

- Parking Spots

- Parking Type

- Last Sale Date

- Last Sale Price

- URL

Now we can start filtering to eliminate properties that aren’t really comparable. (For the spreadsheet challenged: select the top row and click “Sort & Filter” in the toolbar, then click “Filter”. See the down-facing arrows that popped up along the top row? If you click them, they let you sort and filter that row.)

Let’s take this in phases.

Phase I

The first item to filter is the date. Click on the arrow next to “Last Sale Date” and sort newest to oldest.

You don’t want to use comps that sold way before today because the market has likely changed over the last year, so we’re going to remove properties that sold too early. “Too early” will vary by area; if you live in an area with fewer sales, you have fewer comp options, so you may need to go further back from the lien date to find good comps than people who live in areas with a really active market. For the average market, focus on homes that sold within the last 6 months. You can always narrow this further as needed.

All the homes that sold before the last 6 months can be removed. WAIT – did you notice I said “removed” instead of “deleted”? Trick of the trade: don’t “delete” any property records. Instead, just cut and paste those rows into a separate tab and highlight the reason for removing those comps from consideration by changing the font color (for example, change the date to red if the reason you removed a property was because of the date). This is super helpful when your client asks about a specific property because you’ll be able to explain why you chose not to use that property as a comp.

Phase 2

Use your filter to sort beds smallest to largest. I recommend removing properties that are more than one bed different from your subject. For example, if you have a 5-bed, keep the 4-, 5-, and 6-beds, and remove the rest. Baths are a little more flexible, but you should remove anything crazy far off. With 1.75 baths, a 4-bath home would be too different. Again, cut those rows and paste to your second tab, then change the font of the number of beds / baths to red to note why those properties were eliminated.

Phase 3

Now let’s look at square footage. Using a general rule of 50% either way, I’ll say that anything more than 50% bigger or less than 50% smaller than your subject is not comparable.

How about lot size? I use a 100% rule instead of the 50% rule for land because lot size varies more than home size.

Phase 4

Let’s talk about the year built. Year built can be tricky when there are extensive renovations. If your subject was built in the 1960s, but renovated in 2010, unrenovated 1960s homes are no longer comparable. But you might have to look at individual property photos to see if homes were renovated. So don’t eliminate properties unless you have a good reason. For example, if you have a 1960s home that’s not been renovated, homes built after 1980 or so can probably be eliminated as being too different from your subject. Again, this is largely subjective and depends on the activity in your local market.

Phase 5

At this point, you can go through your list and remove any last properties with a glaring material difference from the subject property. Views, garages, proximity to a freeway…these could all be reasons to eliminate a property from your comp list.

Phase 6

For the remaining properties, it’s time to look through some pictures to see if homes are comparable to your subject. If your subject is a sweet country-style ranch house, you can remove the ultra-modern, all-window, box-structure house. If you have a freshly-renovated kitchen with all new appliances, you may want to remove the properties with the original 1950s banged-up cabinets and avocado-colored appliances.

| Struggling to find enough good comps for your case? Try expanding your search area to adjacent neighborhoods similar to yours or looking for sales occurring slightly earlier. |

Also, you’ll probably see some listings with only one exterior photo and very little info. You’ll want to remove those properties because they just don’t provide enough evidence to be a good comp. If you run out of houses, you can always revisit some of those you removed. Have fun with this, and enjoy learning more about the homes in your local market!

Phase 7

We finally reached the final phase of comp selection! It’s time to choose the 3 – 5 comps you’ll use to determine your value. You really only need 3. Having more than 3 requires a little more work because you would need to make valuation adjustments for the additional comps (which we’ll go over in the Valuation Section). I usually choose the top 3 most comparable properties and 1 or 2 “back-ups”. If you still have more comps than you need, the ones closest to your property are going to be the best indicators of fair market value for your house. Location, location, location!

Step 3: Enter and Adjust Your Comps

Now that you have your comps, I’m going to tell you how to use them to properly value your subject property.

You found 3 – 5 properties that are similar to your subject, but there are still some material differences. One of your comps may have fewer bedrooms, one may be older, and one may have a much better view than your subject property. These differences affect the value of the homes. To make sure you are comparing apples to apples, you need to make value adjustments to these comps to account for these differences.

For example, if your subject has 3 bedrooms, and one of your comps has 2 bedrooms, you need to add a (metaphorical) bedroom to the comp to make it equal to your property. If a bedroom in your market is worth $35,000, you would add $35,000 to the comp to adjust the value for the bedroom. Make sense?

You will make both positive and negative adjustments to your comps. The rule is: when a comp is superior to the subject in an area, you adjust that area negatively, and when a comp is inferior to the subject in an area, you adjust that area positively. This brings the comps to the same level as the subject in each area. You always adjust the comps, never the subject.

Of course, there are probably several items that need to be adjusted on each comp. A good template will save you hours of frustration by auto-calculating many of your adjustments!

Regardless of your CMA template or subscription, you’ll make your adjustments in three phases.

Phase 1: Identify Areas to Be Adjusted

Here are examples of adjustments you’ll want to consider making

- Number of rooms

- Square footage

- Lot size

- Time of sale (only if the comp sold more than 90 days ago and the market has since changed)

- Location (only if there is some material difference in location like a cul-de-sac location vs. a through street location, for example)

- Amenities (only if a comp has a pool, spa, tennis court, sauna, etc., that your subject doesn’t or vice versa)

- Year Built (typically only needs to be adjusted if there is more than a decade variance between the subject and comp)

- View (only if there is a material difference between the subject and comp)

- Quality (only if there is a material difference between the subject and comp)

Phase 2: Determine Adjustment Values

Comp adjustments values are the specific amounts you add or subtract to your comps for each item. For example, an additional bedroom may be worth an extra $15,000 in your market under today’s standards. A mountain view may be worth $20,000 while an ocean view may be worth $50,000.

Comp adjustments vary in terms of both submarket and time. Unfortunately, there is no reference guide containing rule-of-thumb comp adjustments for a given submarket at a given time. If you’re new to real estate, get with your mentor or broker to discuss adjustment values for your local market under current market conditions.

Phase 3: Make Your Adjustments

Now that you know what needs to be adjusted and adjustment values to use, you can make your adjustments. Again, if the comp is superior to the subject, you make a negative adjustment, and if a comp is inferior to the subject, you make a positive adjustment.

Step 4: Determine a Value

With your adjustments made, your comps are now reflecting values that can help you determine the value of your subject property. When you divide the adjusted values of each comp by the square footage of each comp, you can see the price per square foot (PPSF) for your comps. In all likelihood, these figures will be fairly close to one another. And they’ll give you an idea of the PPSF for your subject. But there’s one more thing you can do to make your valuation more accurate: weight your comps.

Weighting your comps means giving more weight to the property most similar to your subject and less weight to the properties less like your subject. This process is largely subjective, but you want to try to weight your comps according to their similarity to the subject. Adding up the total value of the adjustments for each comp is helpful because it shows you which comp required the fewest adjustments (because it was already most similar to the subject property), and which required the most adjustments (because it was least similar to the subject property).

If all comps are equally similar to your subject, they would each be weighted at 33.33%, and you would simply use the average PPSF as is. If one property is more similar, you could weight it at 50% and weight the other two comps at 25%. Again, this step is up to you.

Step 5: Present Your Findings

The final step in completing a CMA is to present your findings. You can do this in a few different ways:

- Save your CMA Workbook as a PDF to email your clients.

- Save your CMA Workbook as a PDF to present to your clients on your computer or tablet during your meeting.

- Print the workbook so you have a hard copy to present to your clients at your meeting.

When presenting your CMA, the most important thing is that your clients understand that the market decides the value. You don’t decide the value, and the clients don’t decide the value; only the market decides.

The second most important thing in presenting your CMA is that your clients get on board with the findings. You need to explain to them how the CMA works and how your calculated value is supported by market data.

Finally, your clients need to be aware of the risks of ignoring your value. Warn sellers that some agents will list at a higher-than-market value simply to get their name on a listing, which helps them promote their business. Warn buyers that a low-ball offer may not even be countered. It’s your job to sell your clients on your findings of value.

CMA FAQs

What is the purpose of a CMA?

A CMA helps you determine the market value of a property by comparing recent sales of similar properties. This is often used to help your sellers set the asking price for a new listing, help your buyers decide on an offer price, or help your homeowners reduce their property taxes.

How is a CMA different from an appraisal?

An appraisal is a formal valuation, completed by a state-licensed appraiser. A CMA, on the other hand, is an informal opinion of value and can be completed by anyone.

Where do I get a CMA template?

You can use an online service provider (like Cloud CMA or Toolkit CMA) that charges a monthly subscription fee, make your own Excel workbook, or buy an inexpensive Excel template online.

How many comps should I use?

You generally want to thoroughly review 5-10 comps and choose the 3 that are most similar to your subject property.

How long does it take to do a CMA?

It depends on the subject property and the number of comps available. CMAs for properties with just a handful of ideal comps may only take 10-15 minutes, while CMAs for properties with lots of comps or too few comps can take an hour or more. The more CMAs you do, the faster you’ll get.

Why is my CMA value different from other agents’ values?

Property valuations are somewhat subjective. Other agents may choose different comps than yours. And other agents may use different amounts to adjust the values of the comparable properties. But if both agents are genuinely choosing the comps they feel are most similar to the subject (as opposed to cherry-picking high-value or low-value comps) and are using fair adjustment values, the resulting value estimates should be close.

Can I get paid for running comps?

Yes! The most common way to get paid for running comps is to offer Broker Opinions of Value (BOVs). BOVs are often ordered by property owners as inexpensive alternatives to appraisals when a full appraisal isn’t necessary. Perhaps a property owner wants a fairly accurate estimate of the value of their real estate holdings to assess their net worth. A BOV would serve this purpose.

How else can I make money from CMAs?

One of the best ways to make money from CMAs is to use them to attract new clients. Offering a free CMA to homeowners can start the conversation that could result in a new listing for you!

A virtually untapped way to make money from CMAs is to use them to appeal your clients’ property taxes. This may sound difficult, but it’s actually quite easy. Millions of homeowners are over-taxed every year because the County Tax Assessor thinks real estate is worth more than it really is. So they’re calculating property taxes based on inflated value assessments. You can use a CMA to show your Tax Assessor that your client’s property is worth less than estimated, which will reduce your client’s property tax bill. You just need to sell your property tax appeal services to local homeowners so you can collect a percentage of the tax savings once you successfully lower their taxes.

Get a Small Win

Great victories are the result of small wins. Before you move on with the rest of your day, get a small win.

Today’s small win challenge is to learn how to do a CMA by practicing. Choose 2-3 homes in your market, open your CMA template (whether you create your own, use a subscription, or buy an inexpensive downloadable template), and determine the fair market value for those few properties. Don’t get discouraged if these first few take a little time and effort. They will get faster and easier with practice!