Financial planning for real estate agents is different from financial planning for salaried employees. Honestly, it’s harder. But, ultimately, it gives you more control over your finances.

In this article, we’re breaking down this giant topic of financial planning for real estate agents. You’ll learn how to:

- Budget properly for your unstable income,

- Save and invest for future financial stability, and

- Fund your short-term and long-term dreams.

But first, let’s see exactly what makes your finances different from those of a salaried employee.

Key Differences Between Financial Planning for Real Estate Agents vs. Salaried Employees

- Salaried employees automatically get their taxes, insurance, and retirement contributions withheld from their paychecks. You have to manually calculate and track these expenses whenever you get a commission check.

- Salaried employees have a stable income. Agents’ income isn’t always stable; you can’t know exactly how much you’ll make three months from now.

- Salaried employees only have to budget for personal expenses. You have to budget for personal and business expenses.

- Salaried employees have limited earning potential. Their income won’t exceed their salary (plus any bonuses). Your income potential is unlimited. Working smarter, harder, or longer can mean more money for you to spend, save, or invest!

These differences require real estate agents to handle their finances differently. Smart money management is key to building a sustainable lifestyle that makes you happy.

Quick note: I am not a certified financial advisor. I am simply a business owner with lots of experience managing my own finances and writing content for banks, mortgage lenders, and investment firms.

Budgeting for Real Estate Agents

Budgeting is a cornerstone of financial planning. A budget allows you to allocate your spending on things that matter most to you and prevents you from overspending on things without substantial meaning to you.

I love a budget because it takes the guilt out of spending. I, for example, spend a small fortune on books because they make me happy. Without a budget, every book I buy is questionable; can I afford to buy this or is my money better spent elsewhere? But when I build my book-buying into my budget, I can buy with confidence, knowing that money has specifically been allocated for my books.

What spending categories are important to you? Beyond the necessary shelter, food, and hygiene? Let’s build a budget that accommodates your joys!

How to Build a “Reverse Budget”

Most people use their income to inform their budget. They see how much money they have coming in every month, and they decide how to spend it. Maybe 40% goes toward housing, 10% covers food, etc.

But since your income is different every month, this traditional budget model doesn’t work for you. You need to use a reverse budget.

A reverse budget is a budget that starts with your expenses to show you how much you need to earn each month.

Take some time to list all your expenses, both personal and business, including the things that bring you joy. Think of this exercise as designing your life. If you want to be able to afford a membership to the local country club, include those membership dues. If you want to take a $5k vacation every year (and that is within reason at this point in your career), write it in!

Note: Many categories are variable expenses, meaning that they fluctuate from one month to the next. For this reason, many agents find it helpful to list the total annual amounts for each category and then divide that amount by 12 to get the average monthly amounts.

Personal expenses include:

- Housing

- Utilities

- Personal Vehicle

- Food

- Personal Care

- Insurance

- Debt Payments

- Savings and Investments

- Charitable Giving

- Your Joys (books, travel, entertainment, hobbies, etc.)

Business expenses include:

- Work Vehicle

- Work Cell Phone

- Office Space (if not covered by your Broker)

- Marketing

- Website Hosting

- Signage

- Membership Dues

- Client Gifts

- Federal and State Income Taxes

Focus on being as realistic as possible as you set your amounts. You might even review your credit card or bank statements to see your actual spending over the last year (many banks and credit card companies will provide a year-end report showing you how much was spent in each category).

Now, total your expenses. This tells you how much you need to earn each month to cover those expenses.

How to Generate Enough Income in Real Estate to Cover Your Expenses

Many agents struggle to consistently generate enough income to be comfortable (particularly in the early years of their careers).

The first rule of generating income in real estate is to prospect for new leads every single workday. This means following up on expired listings, contacting FSBOs, contacting people in your network, and connecting with people on social media. If you’re in a bit of a rut, grab a $5 daily prospecting checklist to help you stay focused!

The second rule of generating income in real estate is to diversify your income streams. Real estate is cyclical, so you’ll have periods of feast and famine. And it pays to have seasonal income streams, passive income streams, and recession-proof income streams, all tied to your real estate business. Need ideas? Check out 55 Ways to Make Money in Real Estate.

Decide now how you’re going to make enough money to comfortably cover your budgeted expenses.

Saving and Investing Strategies for Real Estate Agents

Investing and saving are critical components of financial planning for real estate agents. These are connected concepts, but they mean two different things. Saving money means stashing away cash (or cash equivalents) for unexpected expenses. This is often referred to as an “emergency fund.” Investing means buying assets that can grow your money.

All adults need to have both savings and investments. Your specific savings and investment needs will depend on your unique lifestyle, goals, and risk tolerance. Let’s take a closer look at how to save and how to invest as a real estate agent.

How and Where to Save Money

When it comes to savings, you want to keep enough money accessible (for example, in a savings account) to cover unexpected expenses and emergencies. But you don’t want to keep so much in savings that you miss out on the big financial benefits of investing.

General guidelines suggested that Americans should have enough in savings to cover three to six months of living expenses.

If, for example, your living expenses come to $4,000 per month, you should maintain a savings account balance somewhere between $12,000 and $24,000. Those who have a higher risk tolerance may just keep one month’s expenses in savings. Those with a lower risk tolerance may choose to keep a year’s worth of expenses in savings.

It may take some time to save this amount. That’s ok. You may have to dip into it before it’s fully funded. That’s ok too. Just make sure that you’re putting some of each commission check into this account until you reach your savings goal.

You definitely want to keep your savings out of your checking out so that you don’t accidentally dip into it to cover everyday expenses. Savings are traditionally kept in savings accounts, which are FDIC-insured, so there is no risk of losing your money. And your money will be easily accessible should you need it.

For a better rate of return on your savings, you might choose to keep them in a high-yield savings account, which pays a better interest rate than traditional savings accounts.

How to Invest as a Real Estate Agent

Some financial advisors will tell you to fully fund your emergency savings before you start investing. Others recommend saving and investing at the same time; every time you get a commission check, a percentage of it goes into savings, a percentage goes into retirement investing, and a percentage goes into investing for your other goals. My personal recommendation is to save and invest at the same time simply because it can take a long time to fully fund your emergency savings, and I don’t want you to miss out on the investment gains you could be making during that time.

Smart agents plan for three types of investments:

- Retirement,

- Short-term dreams (those you want to achieve within the next three to five years),

- Long-term dreams (those that will take longer than five years).

Retirement

We’re starting with retirement because this is the most crucial investment account for American agents.

Your lifestyle in retirement depends on how you manage your money now. Not five years from now. Now. Even if you’re 25 years old and have a long career ahead of you, you need to start investing for retirement now.

Do you know why?

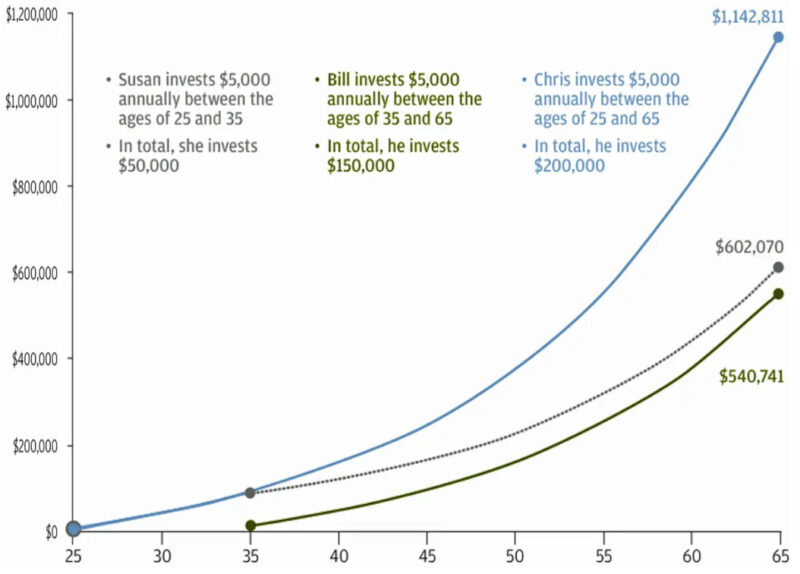

It’s because of compound interest.

You know what interest is: it’s the money you make on the money you invest. Compound interest is when you earn interest on the interest you already earned. So it allows you to make money on the money your money is making! And this means you can grow your money exponentially. So the earlier you start, the more your money can grow.

Just look at this graph showing the difference compound interest makes over time:

By investing as early as possible, you allow time to work its magic, growing your modest investment to more money than you could have possibly set aside on your own.

Retirement accounts are a complex topic, beyond the scope of this article, but here is a simple overview of how they work:

- A financial planner can help you choose a tax-advantaged retirement account like a Solo 401(k), an IRA, or a Roth IRA.

- Financial planners take a share of your portfolio earnings as payment, so you typically don’t have to pay anything out-of-pocket for their service.

- Once your money is in the account, you can choose the specific investments you want to add to your portfolio (like stocks, bonds, and funds). Your financial planner can advise on these investments based on your retirement timeline and goals.

- You can automate your investments so that you only have to review your portfolio periodically to make sure you’re happy with the performance. There’s no need for constant oversight when you’re playing the long game.

How to Save for Retirement if You Missed the Opportunity to Invest Early

The best time to invest was always five years ago; the second best time to invest is always today. Just like buying real estate, right?

If you didn’t start saving five years ago, you may have missed out on some growth, but don’t let that stop you from starting your retirement investing now.

And don’t be discouraged; there are other ways to fund your retirement besides traditional retirement accounts. You could, for example,

- Build a real estate portfolio that generates enough net rental income to fund your retirement.

- Create other passive income streams (such as dividend growth investing or digital product sales).

- Sell your real estate practice when you retire. Another agent may be willing to buy your client base and workflow systems from you for a large upfront sum. Or you could arrange to earn residuals on each sale made by your successor.

Funding Your Dreams

Money is simply a tool for enhancing our lifestyles. What would make a difference in your life a few years from now? A kitchen reno? A vacation? Sending the kids off to college? Expanding your business?

Now, what would you do if you could afford anything? Travel the world? Build your dream home? Launch a non-profit? Open your own brokerage?

Saving for these goals could take forever. But investing allows you to earn a return on your money to grow it much faster.

Generally, the closer you are to your goal, the less risk you can afford to take. And the less risk, the lower the reward potential.

The more time you have to reach your goal, the more risk you can take, and the greater your reward potential can be. That’s why we break down dream investing into two categories: short-term and long-term.

Short-Term Investing

Short-term investment vehicles include:

- Certificates of deposit (CDs)

- Money market accounts

- Short-term bond funds

- Crowdfunding

- Real estate syndication

Long-Term Investing

Long-term investment vehicles include:

- REITs (real estate investment trusts)

- Stock-based index funds

- Mutual funds

- Rental properties

- Alternative investments like collectibles, precious metals, and infrastructure

Ask your financial planner for guidance in determining which of these investment types best serves your unique needs.

Quick Tips on Financial Planning for Real Estate Agents

- Don’t plan to just save whatever is left of your commission check. Set aside your savings and investment contributions first, then you can spend what’s left.

- Automate your savings and investment contributions. Having your contributions pulled directly from your account on payday foolproofs your financial plan.

- Don’t check on your investments every day. The value of your investments will fluctuate with market conditions, so you don’t need to stress over every little dip. Just review your portfolio once a year to see if you want to make any changes.

- Leverage the experience of financial planners. They live in the financial world and can offer valuable insights to those of us who only dabble in finance.

Don’t wait to get your financial plan in order. Now that you have this information on financial planning for real estate agents, every day that goes by is a day that you’re losing out on the compounding interest that can build your fortune. Start your financial plan TODAY by building your budget and making an appointment with a financial planner.